AI in Risk Management: Safeguarding Your Investments

AI in Risk Management: Safeguarding Your Investments Risk management is an essential part of the investment process. Whether you’re managing your personal portfolio or overseeing institutional investments, identifying and mitigating risk is key to preserving and growing your capital. In today’s fast-paced financial markets, managing risks has become more challenging due to the complexity and volume of data involved. With the rise of technology, especially Artificial Intelligence (AI), investment firms and individual investors now have tools that enhance their ability to monitor, analyze, and respond to risks more effectively. AI in cryptocurrency trading, for example, uses advanced algorithms to forecast […]

AI in Risk Management: Safeguarding Your Investments

Risk management is an essential part of the investment process. Whether you’re managing your personal portfolio or overseeing institutional investments, identifying and mitigating risk is key to preserving and growing your capital. In today’s fast-paced financial markets, managing risks has become more challenging due to the complexity and volume of data involved.

With the rise of technology, especially Artificial Intelligence (AI), investment firms and individual investors now have tools that enhance their ability to monitor, analyze, and respond to risks more effectively. AI in cryptocurrency trading, for example, uses advanced algorithms to forecast market fluctuations and optimize decisions. This technological leap has transformed traditional methods, providing real-time insights and making risk management smarter and faster.

Table of Contents

Understanding Risk Management in Investment

Investing comes with various risks, and understanding these risks is the foundation of effective risk management. Risk management in investing involves identifying, assessing, and mitigating the chances of financial loss. There are several types of risks investors typically face:

- Market Risk: The risk of losses due to market fluctuations.

- Credit Risk: The potential for default by a borrower or counterparty.

- Liquidity Risk: The risk of not being able to sell assets quickly enough at desired prices.

- Operational Risk: Risks arising from internal processes, systems, or human error.

Traditional risk management strategies rely on diversification, asset allocation, and hedging to reduce exposure to these risks. However, these methods are often slow, reactive, and limited by human capabilities. This is where AI comes in—offering a more dynamic and data-driven approach to managing investment risks.

The Rise of AI in Risk Management

AI has quickly proven its worth in a variety of industries, and finance is no exception. The integration of AI in risk management is reshaping how investors and firms address risk. Machine learning in portfolio optimization allows AI to analyze vast datasets, identify patterns, and make predictions that were once beyond the capacity of traditional models.

AI technologies such as machine learning, natural language processing (NLP), and predictive analytics are increasingly being deployed to analyze market trends, detect fraud, and predict financial volatility. These technologies enable risk management systems to evolve, from being static and reactive to becoming dynamic and proactive.

With AI in cryptocurrency trading, for instance, algorithms can assess risk across the volatile crypto markets and make trading decisions based on real-time data, helping investors mitigate risks and maximize returns.

AI’s Role in Identifying and Assessing Risks

AI excels in processing massive amounts of data at speed, something human analysts simply cannot match. By ingesting and analyzing both structured and unstructured data, AI can identify early warning signs of potential risks.

Predictive analytics is a prime example of how AI is reshaping risk assessment. It uses historical data to predict future outcomes, allowing investors to anticipate market downturns, economic shifts, and sudden price movements. AI can also detect anomalies in market behaviors, providing early alerts about potential issues before they become severe.

For example, AI models can assess the risk of AI in cryptocurrency trading by analyzing transaction volumes, network activities, and market sentiment. These models are constantly evolving, becoming better at predicting extreme market conditions and identifying systemic risks before they escalate.

Enhancing Portfolio Diversification with AI

One of the most powerful ways to manage investment risk is through portfolio diversification. The more diversified a portfolio is, the less likely it is to suffer from the failure of any single asset. AI plays a crucial role in optimizing portfolio diversification, ensuring that investors are spreading their investments across various sectors, asset classes, and geographical regions.

AI-powered tools can analyze an investor’s portfolio in real time, suggesting adjustments based on current market conditions. By factoring in risk profiles, historical performance, and future market predictions, AI-driven systems help investors make smarter decisions when it comes to asset allocation. This helps reduce exposure to individual risks while maximizing potential returns.

Through machine learning in portfolio optimization, AI evaluates various portfolio structures and continually adapts them to minimize risks while maintaining desirable returns.

AI and Real-Time Risk Monitoring

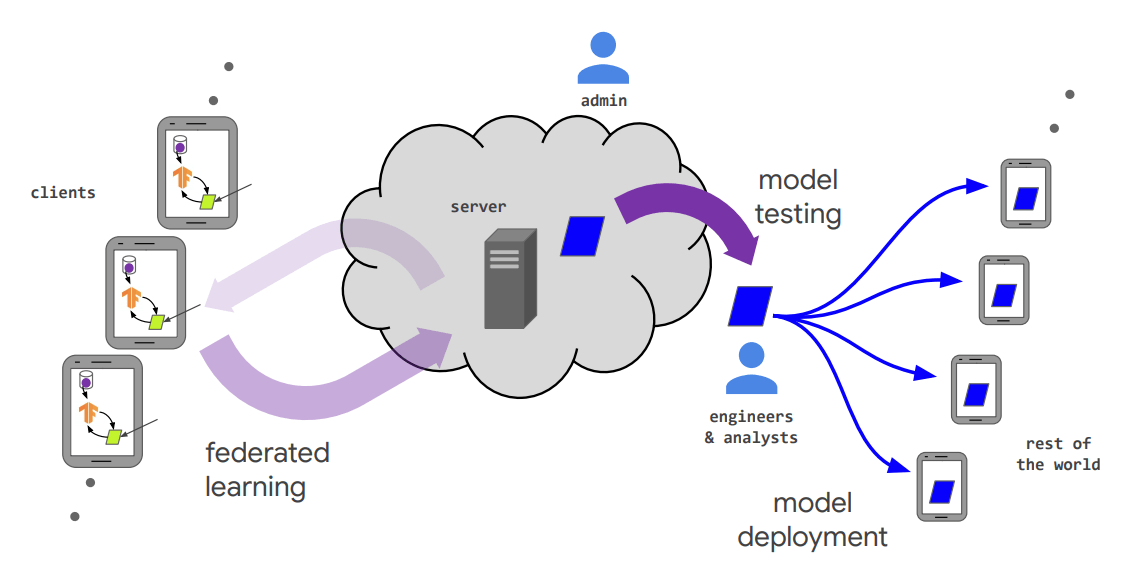

Another key benefit of AI is its ability to provide real-time risk monitoring. Traditional risk management systems often rely on periodic reports, leaving a gap in real-time understanding of the market. AI overcomes this limitation by continuously analyzing market conditions, identifying potential risks as they emerge.

For instance, AI systems track live market data, news feeds, and social media sentiment to detect fluctuations or shifts that might signal upcoming risks. In addition to monitoring financial markets, AI can monitor the risk of non-financial variables like geopolitical events or social unrest, which can impact investments.

For example, using AI in global financial markets, investors can instantly access updates and adjust their strategies based on current data, which is particularly valuable in fast-moving markets like cryptocurrencies.

AI and Scenario Analysis in Risk Management

Scenario analysis is an important part of risk management that allows investors to evaluate how different scenarios might affect their portfolio. AI tools excel in this area by running thousands of simulations based on historical data and predicting how various market conditions could unfold.

For instance, AI can simulate a market crash, political instability, or a financial crisis and assess how these events might impact an investor’s portfolio. This helps investors prepare for worst-case scenarios and adjust their risk profiles accordingly.

By using AI in risk management, investors can explore multiple potential outcomes and understand how to better diversify their assets to weather different economic conditions.

Ethical and Regulatory Considerations in AI Risk Management

As powerful as AI is, there are significant ethical and regulatory concerns that come with its use in financial markets. One of the main issues is the risk of bias in AI algorithms. Since AI models are trained on historical data, they may inherit biases present in the data, leading to potentially flawed decisions.

Moreover, the lack of transparency in AI models—often referred to as the “black box” problem—can make it difficult to understand how decisions are made, which poses a challenge for regulatory bodies.

Financial regulators are increasingly focused on establishing frameworks to ensure that AI in investment and risk management is used responsibly. Balancing innovation with ethical considerations is key to ensuring AI contributes positively to the investment ecosystem.

Future Trends: The Evolution of AI in Risk Management

AI is still in its early stages, and its role in risk management will continue to grow. In the future, AI could become even more integrated into investment strategies, leveraging advanced algorithms, natural language processing, and sentiment analysis.

We might see a greater emphasis on AI in democratizing investment advice, where more individuals can access AI-driven risk management tools that were previously available only to institutional investors. This could lead to a more level playing field for individual investors, allowing them to take a more proactive role in managing their risk.

Additionally, the combination of AI and blockchain in finance could introduce more secure and transparent ways to assess and manage financial risks, improving trust in automated investment solutions.

Conclusion: Leveraging AI for a Safer Investment Future

AI is already making a significant impact on how investors approach risk management. By using AI, investors can gain a deeper understanding of potential risks, make data-driven decisions, and continuously monitor their portfolios in real time. Whether it’s through machine learning in portfolio optimization or AI in cryptocurrency trading, AI empowers investors to protect their assets in ways that were once unimaginable.

As AI continues to evolve, its role in risk management will only increase. Investors who embrace AI-driven solutions will be better equipped to safeguard their investments in an increasingly complex and dynamic market landscape. Embracing AI isn’t just about staying ahead of the curve—it’s about ensuring a more secure and informed investment future.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)