AI for QuickBooks: Automate invoice and AP management

Discover how AI-powered Intuit Assist and Nanonets automate invoice processing, PO matching, and accounting workflows in QuickBooks to save you hours.

Artificial intelligence is transforming how 10 million QuickBooks customers manage their finances. Businesses using QuickBooks' AI-powered features get paid five days faster. They are also 10% more likely to receive full payment on overdue invoices. These capabilities free business owners from tedious bookkeeping tasks, allowing them to focus on growth and strategy.

But it doesn’t stop at built-in AI. If you’re looking to cut even more manual work, specialized integrations like Nanonets can help. It adds another layer of AI-powered automation to your QuickBooks workflows, enabling you to automate information capture, approval routing, and invoice posting.

The result? You get a modern financial stack that once required a dedicated back-office team to manage. Now, enterprises can streamline complex financial operations, reduce manual errors, and give their teams more time for strategic projects without overhauling their existing systems or retraining entire departments.

QuickBooks native AI: features explained

Intuit Assist functions as an AI-powered financial assistant in QuickBooks Online, learning from your business patterns to automate tasks and provide insights. Through a centralized business feed, it monitors your financial data and suggests actions to improve your operations.

Here's how Intuit Assist and other native QuickBooks AI features work:

- Invoice reminders: Create personalized invoice reminders that adapt to each client relationship. You can customize the tone and style of these communications while letting the AI determine optimal sending times based on payment patterns.

- Data extraction: Convert photos of receipts, invoices, and even handwritten notes into QuickBooks transactions. The AI extracts amounts, dates, and line items and automatically populates the relevant fields for review.

- Transaction categorization: When categorizing transactions, the AI provides explanations for its suggestions, showing you why it chose specific categories. This transparency helps you make informed decisions about accepting or adjusting its recommendations.

- Business feed and action plans: The AI-driven business feed monitors your financial data and suggests specific actions. It can generate invoices from conversations and documents, alert you about payment issues, and recommend steps to improve your financial operations.

- Proactive cash flow management: The system analyzes your financial patterns to predict potential cash flow issues before they occur. It recommends payment methods likely to result in faster collection and can connect you with lending options when it identifies potential shortfalls.

- Matching and reconciliation: The AI automatically matches incoming transactions with existing bills, invoices, or receipts in your system, helping prevent duplicates and streamlining the reconciliation process.

While Intuit Assist streamlines many financial workflows, complex enterprise requirements often demand additional capabilities. For instance, organizations processing hundreds of non-standard invoices daily may need more specialized document processing tools.

High-volume transaction matching and receipt capture at scale might require purpose-built AI solutions to maintain accuracy and efficiency. You will need to combine QuickBooks' native features with specialized AI tools like Nanonets to build a more comprehensive financial automation strategy.

How to expand QuickBooks’ AI capabilities?

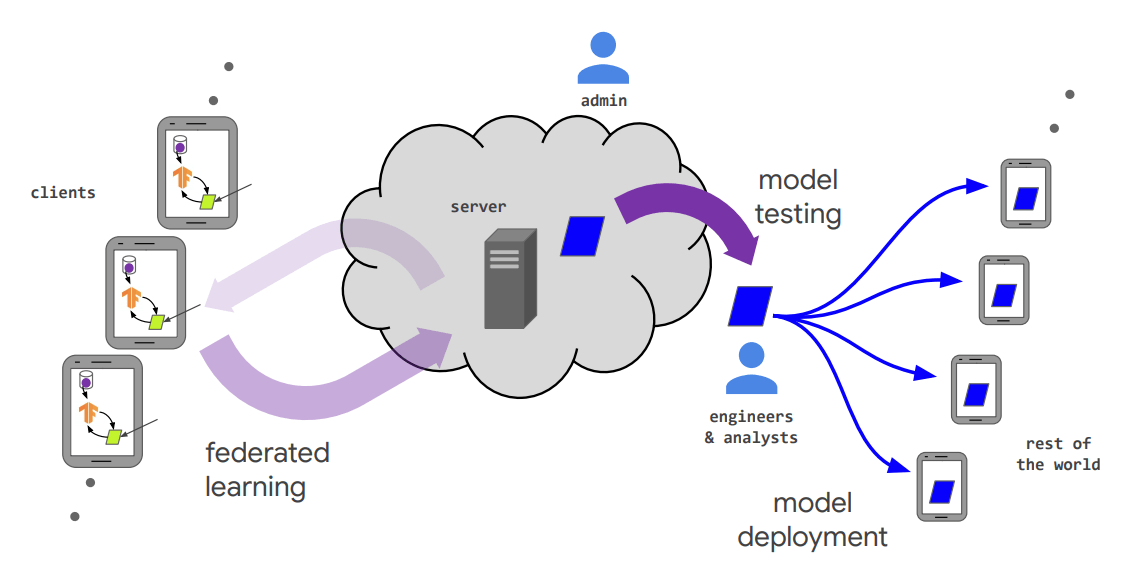

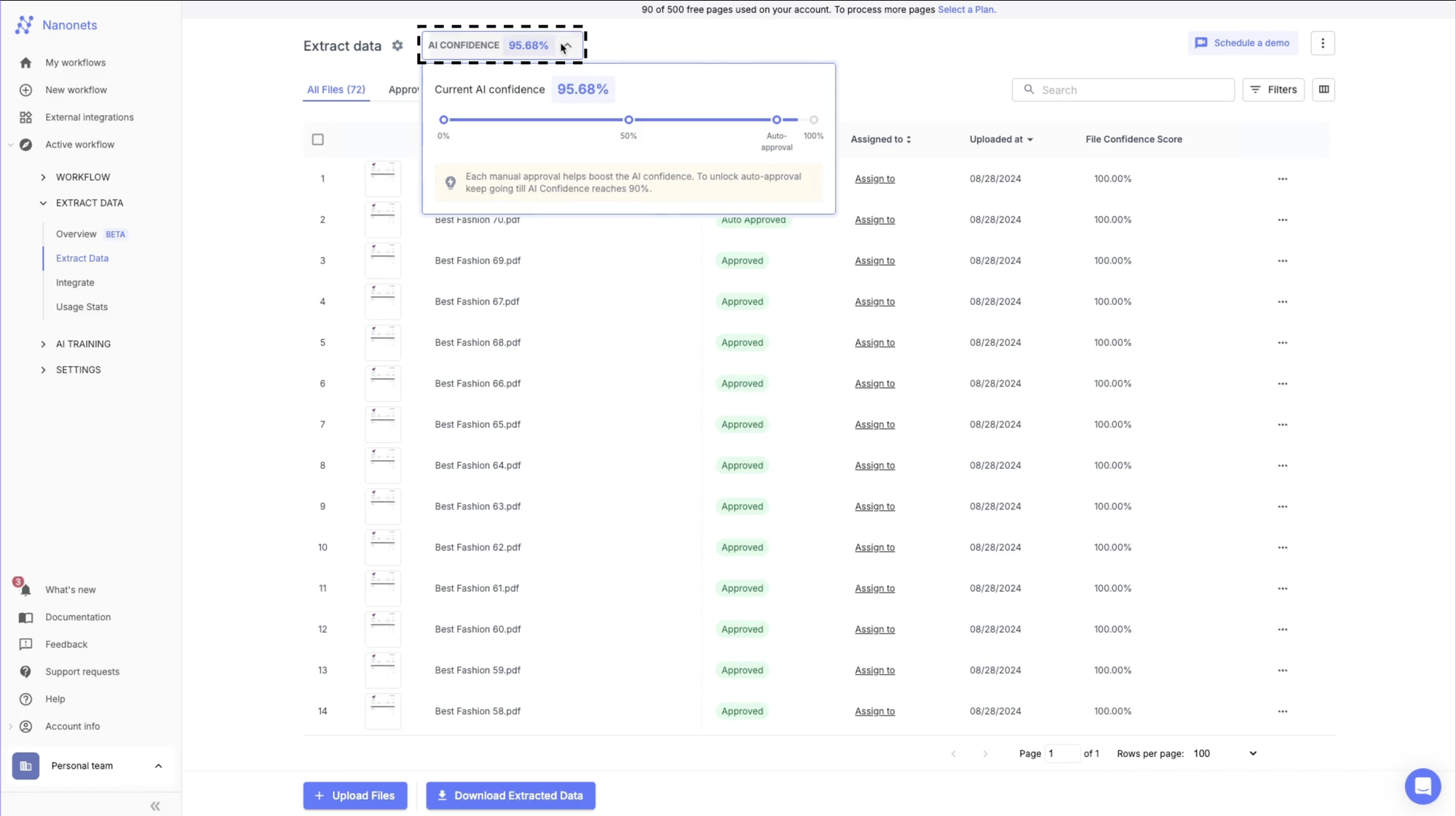

Nanonets is an intelligent document processing platform that integrates directly with QuickBooks. This combination enhances its AI features, particularly for complex document processing and approval workflows. You'd be able to handle documents in any format or language, with the AI learning and improving as it processes more of your specific document types.

Let me show you how Nanonets can help expand your QuickBooks AI capabilities:

1. Automated document processing

Getting invoices and purchase orders into your accounting system is often the first bottleneck. Many businesses waste hours manually downloading attachments from emails, sorting through different formats, and typing data into QuickBooks.

Nanonets solves this through automated document intake channels:

- Forward invoices directly from email

- Connect your ERP system for automatic import

- Upload documents through the web interface

- Monitor specific folders for new documents

The system processes these documents using AI-powered OCR to:

- Extract key fields like invoice numbers and amounts

- Capture line item details automatically

- Convert dates into standardized formats

- Present data in both form and tabular views

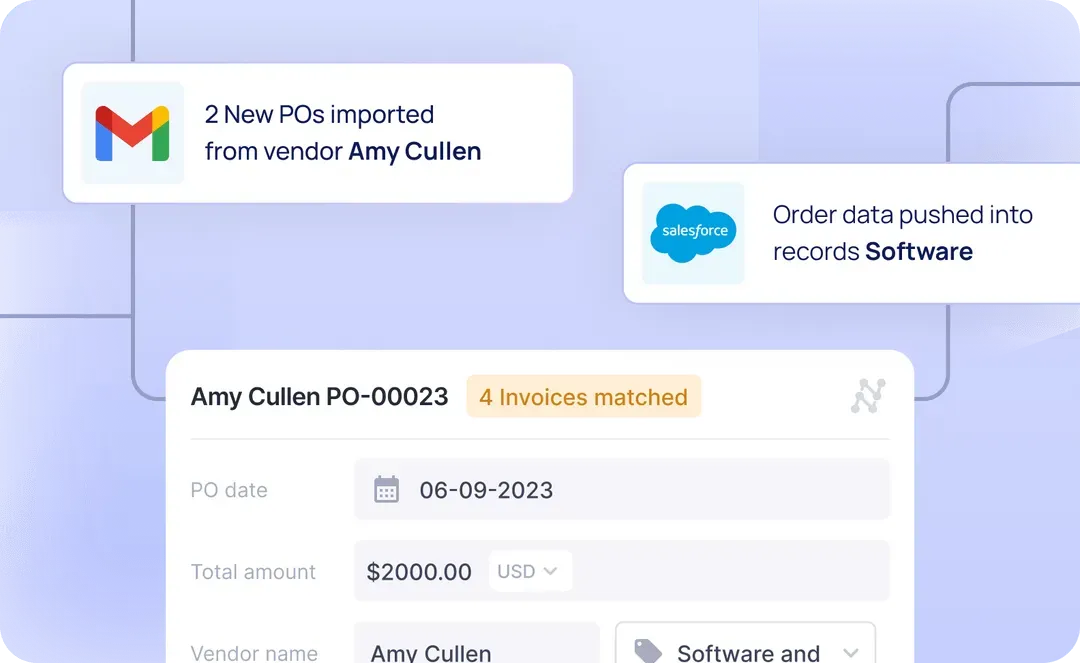

For example, when a vendor emails an invoice, simply forward it to your dedicated Nanonets email address. You can see the same in the GIF above. The system automatically processes the document and extracts the data, turning what used to be a 5-minute manual task into a 30-second automated workflow. For a business processing 100 invoices monthly, this could save over hours of manual data entry time.

2. Intelligent PO matching

Purchase order matching is typically a tedious process where AP teams manually cross-reference invoices against POs and receiving reports. This often leads to payment delays, duplicate payments, or overpayments when discrepancies go unnoticed.

Nanonets automates this verification process through intelligent three-way matching:

- Automatically pulls matching PO data from QuickBooks

- Validates invoice totals against PO amounts

- Matches individual line items for quantity and price

- Verifies vendor details against QuickBooks records

- Flags any discrepancies for review

The system performs specific validations and clearly flags issues when:

- Invoice amounts don't match PO values (e.g., $2,106 invoice vs $3,138 PO)

- Line item quantities differ from ordered quantities

- Shipping quantities don't match ordered quantities

- Prices have changed from the original PO

For example, when processing an invoice, the system automatically pulls the corresponding PO from QuickBooks and compares each line item. If an invoice shows a quantity of 2 units while the PO specified 1 unit, it immediately flags this discrepancy. The AP team can then review just these flagged items instead of manually comparing every detail, turning what was typically a 15-20 minute verification process into a quick 2-minute exception review.

3. Automated QuickBooks export

After invoice processing and validation, finance teams often face another time-consuming task: manually creating bills in QuickBooks. This process typically involves switching between systems, re-entering data, and attaching documents. It opens up opportunities for errors and duplicates.

Nanonets streamlines this through direct QuickBooks integration:

- Choose between account-based or item-based bills

- Create direct expense entries

- Select specific AP accounts for posting

- Map invoice fields to QuickBooks fields

- Handle inventory item tracking

The system offers flexible export controls:

- Export upon approval or after specific validations

- Split exports by page or entire document

- Include attachments automatically

- Sync vendor lists in real-time

- Track export status and errors

For instance, when an invoice is approved, Nanonets automatically creates a bill in QuickBooks with all the correct categorizations, line items, and attachments. The system even maps inventory items correctly, updating quantities and costs. Invoices can flow automatically into QuickBooks in seconds, with validation checks ensuring accuracy at every step.

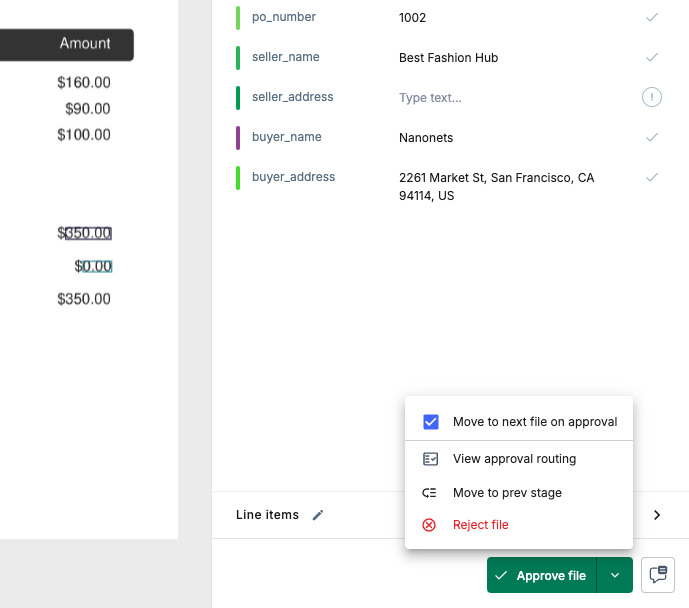

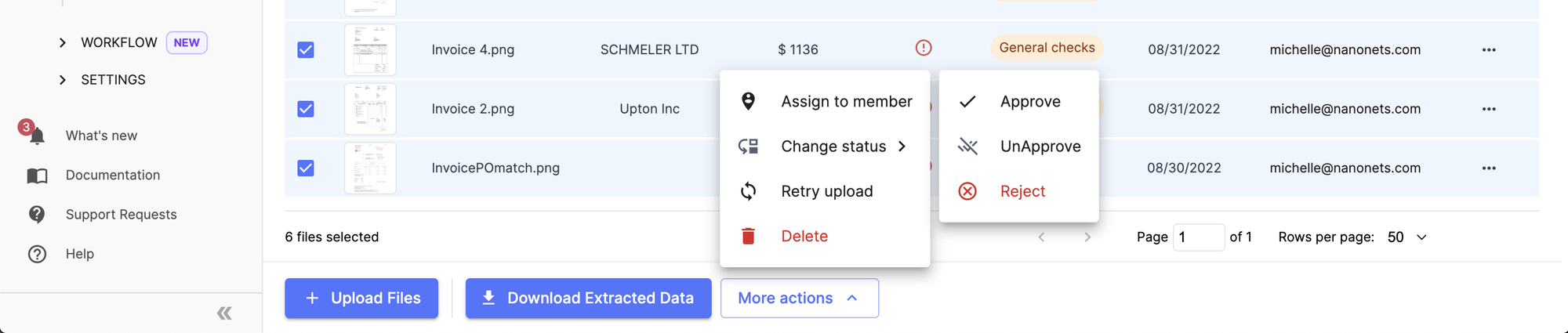

4. Seamless approval flow

Businesses often struggle with invoice approvals getting stuck in email chains or lost in paper trails. Without a structured workflow, tracking who needs to approve what and when becomes a guessing game, leading to payment delays and vendor frustration.

Nanonets structures your approval process through:

- Customizable approval workflows based on amount, vendor, or department

- Automatic reviewer assignment

- Real-time validation alerts

- Complete audit trail tracking

The system automates communication by:

- Sending email alerts for pending approvals

- Notifying reviewers about validation failures

- Enabling comments and team tagging

- Tracking all communication in one place

- Maintaining conversation history for audit purposes

Say when an invoice fails PO matching, Nanonets automatically routes it to the appropriate reviewer with all relevant details and comparison data highlighted. Reviewers can comment, tag team members, and track changes within the one interface. You won't have to worry about scattered approval processes anymore.

5. Touchless data enhancements

Preparing invoice and purchase order data for export can require more than simple extraction. Teams often need to standardize formats, apply business rules, and ensure all critical fields are correct before pushing records into QuickBooks. Without automation, this step becomes a repetitive manual checkpoint that slows down your workflow and increases the risk of errors.

Nanonets addresses this with flexible data actions and enhancement steps:

- Automatically formats dates into ISO standards

- Cleans and converts monetary fields to match accounting requirements

- Performs custom lookups, such as verifying PO numbers in QuickBooks before export

- Creates conditional logic for field validation, such as flagging missing required values or checking for duplicates

- Supports user-defined scripts for complex business rules

For example, if you receive invoices from international vendors with varied date formats and currencies, Nanonets can convert dates and amounts into your preferred QuickBooks format as part of the workflow. If an invoice doesn’t match an existing PO, the system flags it for review automatically. These enhancements save manual effort and ensure data integrity across your financial records.

Each of these steps can be adjusted based on your specific requirements. The system continues to learn from your documents and processes, improving accuracy over time through machine learning. Finance teams can focus on reviewing exceptions and strategic analysis while the AI handles routine processing.

Real-world benefits and success stories

Combining QuickBooks' native AI with specialized document processing tools delivers tangible improvements to financial operations. Organizations implementing this integrated approach report significant reductions in manual data entry, fewer errors in their financial data, faster processing cycles, and the ability to scale operations without proportionally increasing headcount.

These efficiency gains translate directly to bottom-line benefits: lower processing costs, better cash flow management, and more time for strategic financial activities.

Here are examples of how different businesses have implemented this approach and the results they've achieved:

1. Happy Jewelers: 90% reduction in document processing time

Happy Jewelers, a family-owned business with multiple jewelry stores across California, Chicago, and New York, struggled with invoice management as they expanded.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)