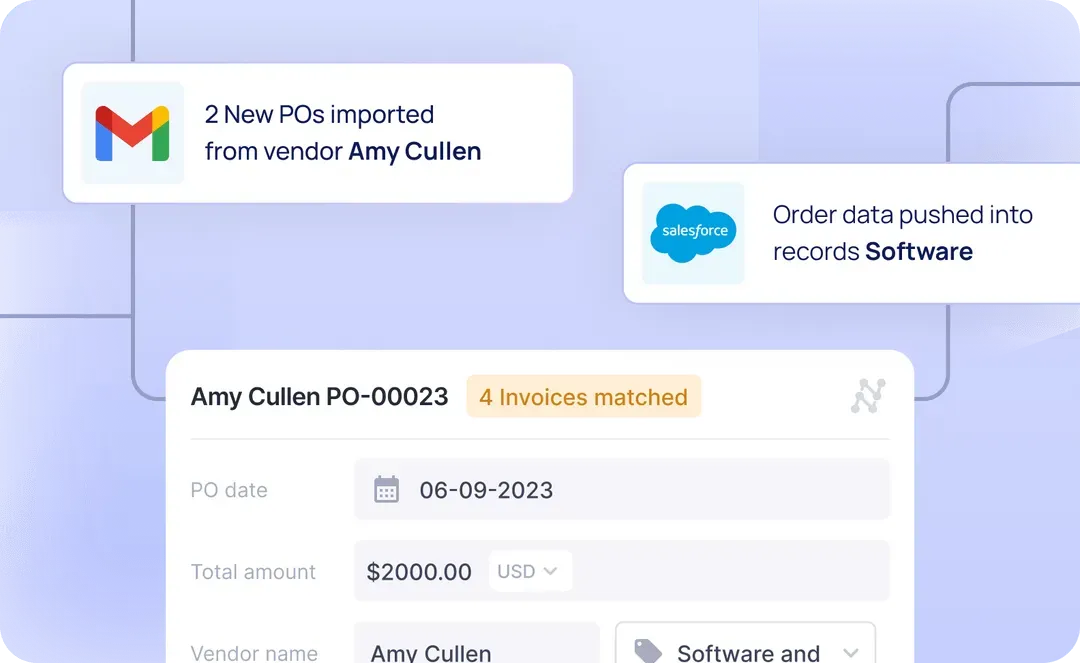

How to prevent order discrepancy with automated PO-SO matching

Explore how a distributor automated verification of sales orders against purchase orders to reduce discrepancies. Learn about its impact on cash flow and fulfillment.

If you run a distribution business, you know the drill: customers often reject invoices due to purchase order and invoice discrepancies, resetting their payment terms while tying up your working capital at 9%+ interest.

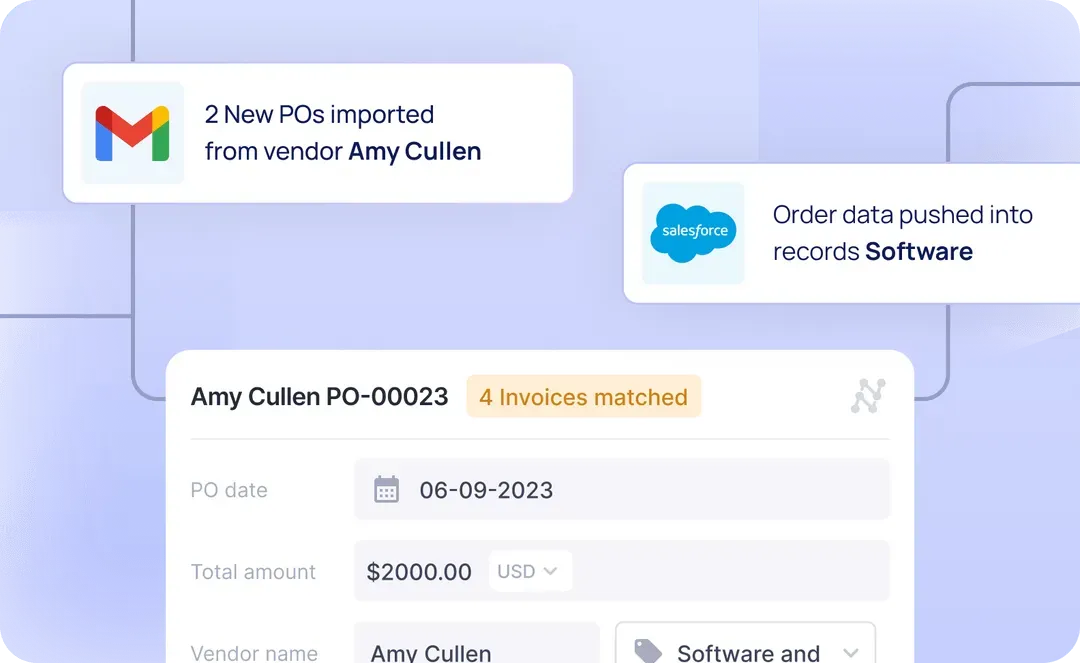

Let’s explore how a mid-sized distributor solved this by scaling their purchase order-sales order verification process before shipping – without adding headcount or disrupting existing workflows.

The real cost of order discrepancies in distribution

Order discrepancies often slip through to post-shipping discovery. It's inevitable when you're processing thousands of orders monthly. But when your customer rejects an invoice because their purchase order (PO) doesn't match your sales order (SO), they're not just creating a headache — they're holding onto your working capital.

For one mid-sized distributor processing 4,000 orders monthly, this meant significant costs and strained accounts receivable cycles. Their accounting team could only manually verify SOs against POs when the value exceeded $10,000, leaving most shipments vulnerable to costly discrepancies.

At current interest rates above 9%, every delayed payment hit hard. Once materials are delivered, customers have zero urgency to fix these issues. Each invoice revision resets payment terms, creating a costly cycle of delays and working capital constraints. Beyond that, these discrepancies could also frustrate customers and potentially lead to the loss of future business.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)