What are some trends that mattered to SEA audiences (and the media) in 2024?

Tracking industry trends, and learning what audiences and the media have to say about them, is a large part of what we do at Isentia. With that in mind, we’ve gathered together 5 of the most interesting ones we spotted this year in South East Asia, to hone in how the region reflects (and defies) […] The post What are some trends that mattered to SEA audiences (and the media) in 2024? appeared first on Isentia.

Tracking industry trends, and learning what audiences and the media have to say about them, is a large part of what we do at Isentia. With that in mind, we’ve gathered together 5 of the most interesting ones we spotted this year in South East Asia, to hone in how the region reflects (and defies) global trends.

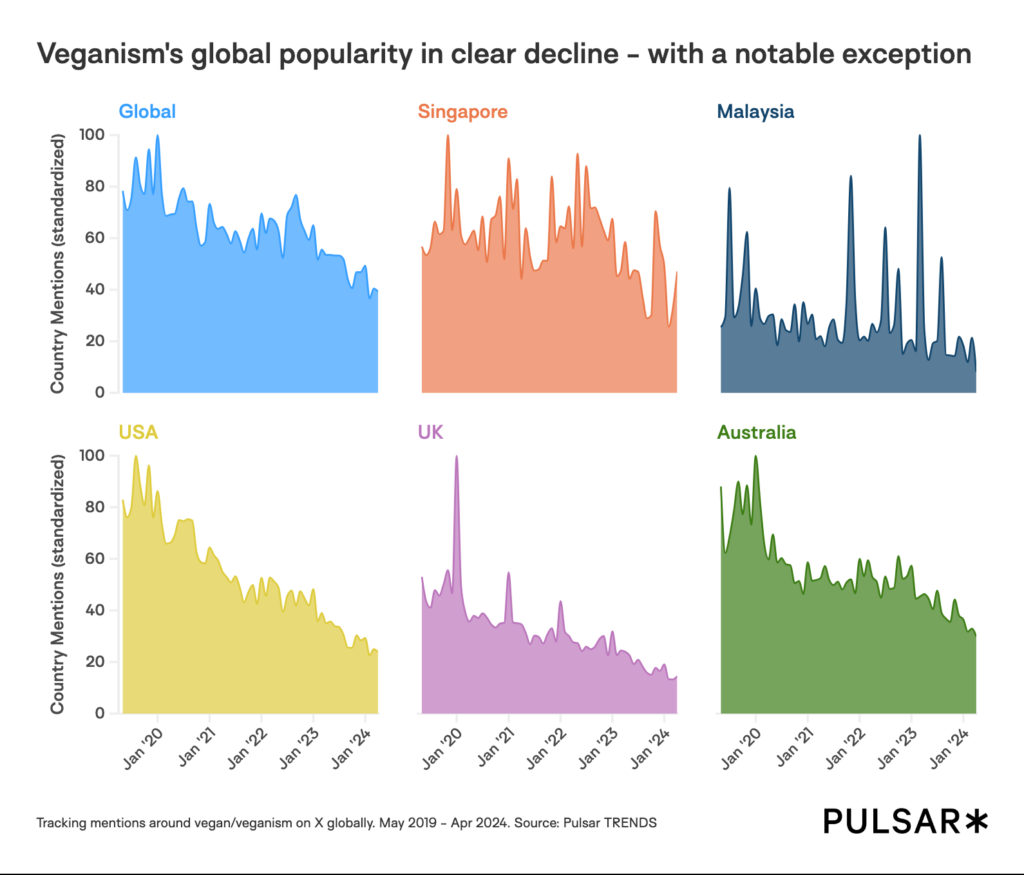

SEA audiences buck global veganism trends amid a broader decline

Over the past five years, mentions of veganism have experienced a noticeable global decline across major markets like the USA, UK, and Australia. However, Southeast Asia, particularly Singapore and Malaysia, buck this trend by maintaining steady interest in veganism. Singapore’s relatively higher mentions compared to neighbouring countries suggest a niche but engaged demographic focused on plant-based living. This suggests that audiences in Singapore, with access to a range of gastronomic options and consistent cultural exchange with other communities, are open to embracing a greener lifestyle, although adapting to this lifestyle can be more of a challenge for other Southeast Asian countries with strict dietary preferences.

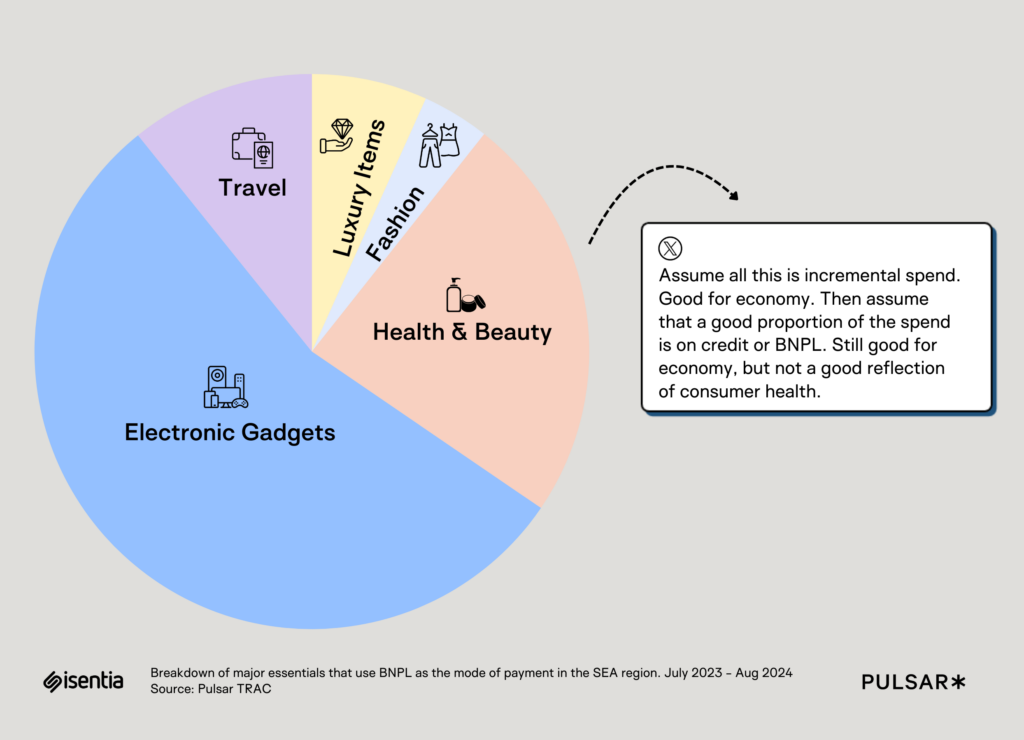

Nice-to-haves still drive most SEA conversation around BNPL

With an increased penetration of mobile phones in the region, Buy Now Pay Later apps have started to thrive, giving an illusion of affordability to younger generations. The breakdown of BNPL transactions reveals that electronic gadgets dominate consumer spending, followed by health and beauty products. While this incremental spending is positive for the economy, the significant reliance on credit and BNPL schemes highlights concerns about consumer financial health. These insights present dual opportunities for brands to align strategic campaigns in consumer goods categories like electronics and beauty products, while also addressing concerns around responsible spending.

We can benchmark this conversation against what is taking place in the UK, for instance, where the conversation skews towards borrowing for essentials, specifically household bills, medical bills and automotive payments. Media discussions suggest increased calls for regulation and consumer transparency.

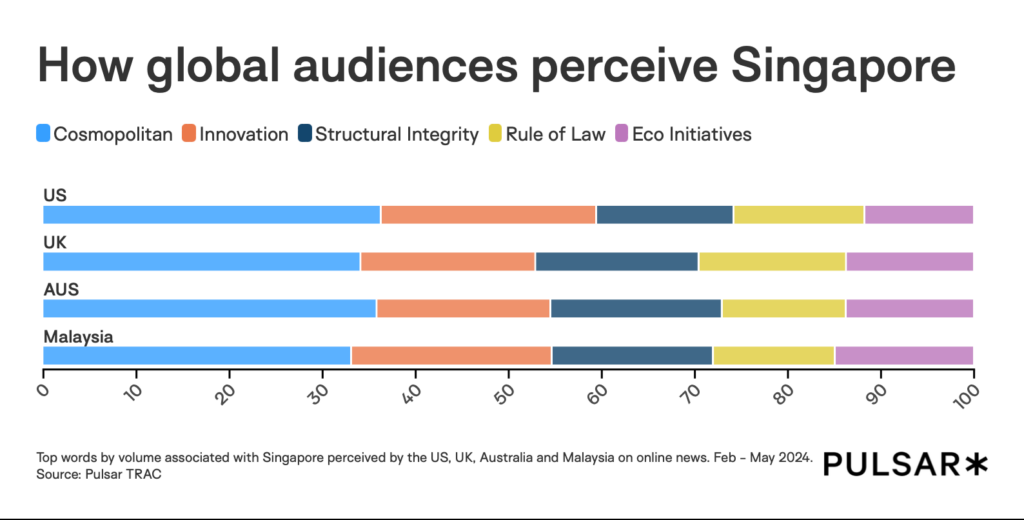

Singapore maintains image as “global hub” throughout fractious geopolitical period

The Singapore brand has been receiving global attention, whether it’s talk around how efficient the public transport is or the way that Singapore dealt with Covid-19. When we look at associations that most resonate with Singapore globally, words like “cosmopolitan” and “innovation” dominate in the US, UK, and Australia. Malaysia’s perception mirrors this positivity but places slightly more emphasis on structural integrity and rule of law. This uniformity in perception presents an excellent opportunity to reinforce Singapore’s positioning, where the government is trying its best to mirror what the world expects of the city-state. PR & Comms professionals must leverage these strengths through storytelling or partnerships that can solidify Singapore’s brand equity on the global stage.

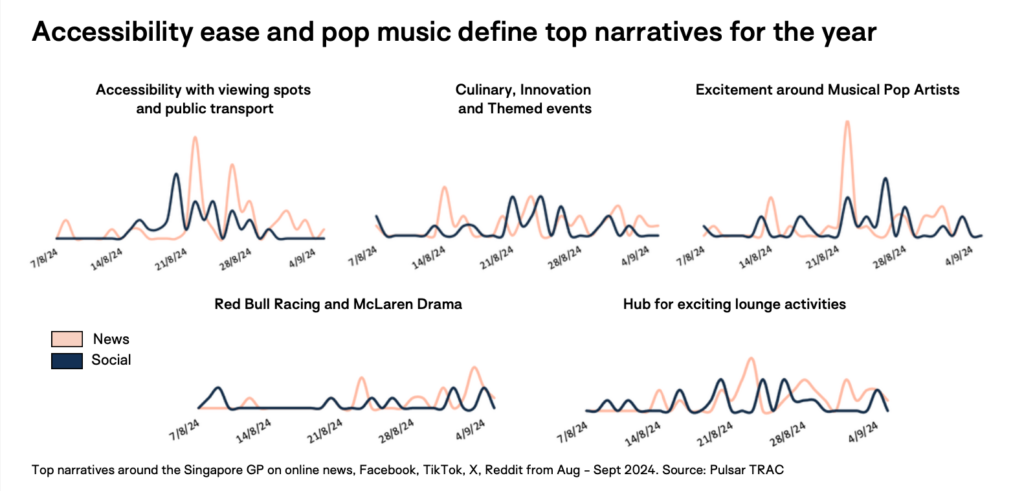

Singapore GP narratives extend far beyond the glamour of the sport itself

This chart highlights how specific narratives dominated online conversations leading up to the Singapore Grand Prix, including accessibility to the venue, themed events, and pop music excitement. This suggests how media coverage builds up anticipation and excitement amongst audiences towards the sport. Peaks in mentions suggest that audience interest surged around logistical convenience like public transport and viewing spots as well as entertainment offerings like musical acts and innovative culinary experiences. Leveraging audience intelligence, we understand that there is more to the event than glamour, emphasising emotional and logistical appeal, and that it provides an opportunity for partner brands to gain audiences to maximise engagement during high-impact events such as these.

Alternative voices focus on government policies and influence of public discourse as dominant narratives in SEA

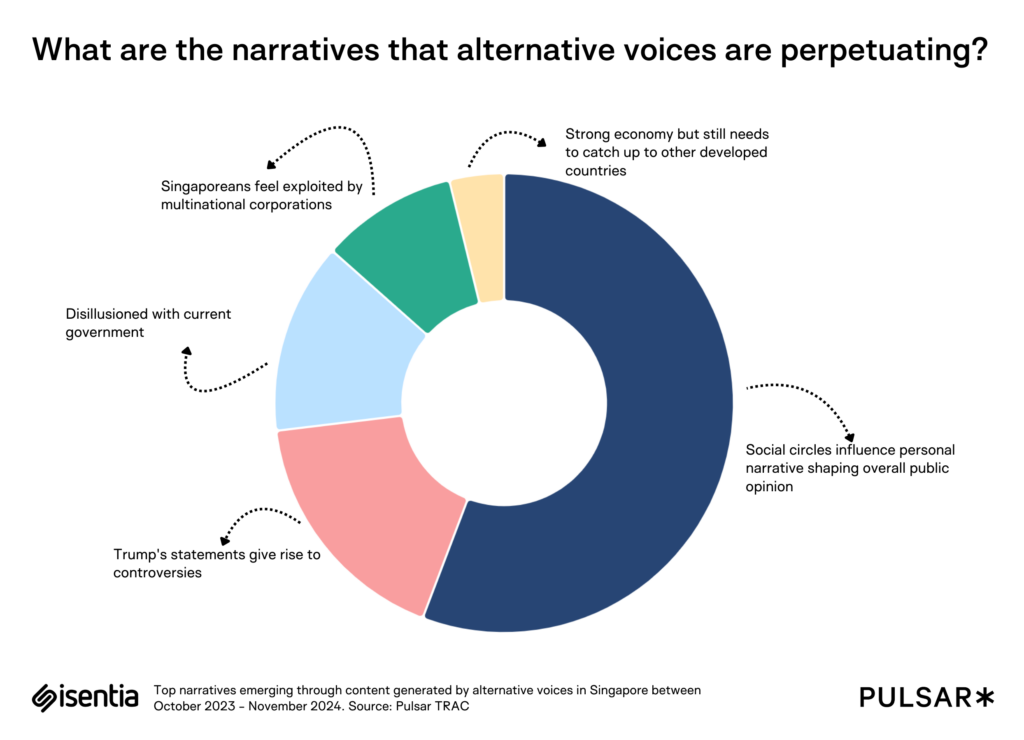

The chart highlights key narratives from a selection of top alternative voices in Southeast Asia, and their impact on shaping public opinion. A dominant theme is the influence of social circles in shaping personal and public narratives. This trend underscores the power of peer networks in driving sentiment and perceptions, often overshadowing traditional sources of influence.

Additionally, issues such as disillusionment with governance and perceptions of exploitation by multinational corporations are gaining traction in a city-state with rising costs of living. For communicators, these findings emphasise the importance of audience intelligence for understanding how communities talk to one another, who act as information brokers, and what topics there is most appetite to learn about.

These insights illustrate how monitoring media trends and audience sentiment equips brands to better anticipate shifts in consumer behavior, refine their messaging, and build deeper connections with their audiences. In a region like Southeast Asia, where cultures and lifestyles are heterogenous, this becomes even more pronounced.

The post What are some trends that mattered to SEA audiences (and the media) in 2024? appeared first on Isentia.