The Future of AI in Trading Bots

The future of AI is increasingly intertwined with the development and utilization of AI technology in trading bots. These advanced tools are transforming the landscape of automated trading by leveraging machine learning and data analysis to enhance trading strategies. Here’s a closer look at how AI technology is shaping the future of trading bots: Key Features of AI Trading Bots Data Analysis: AI trading bots can analyze vast amounts of market data at incredible speeds. They identify patterns and predict future trends, allowing for more informed trading decisions. This capability is crucial as it enables bots to react to market changes faster than human traders. Emotionless Trading: Unlike human traders, AI bots are not influenced by emotions such as fear or greed. This leads to more consistent trading results, as decisions are based solely on data and predefined strategies. 24/7 Operation: AI trading bots can operate around the clock, ensuring that no trading opportunities are missed, even outside regular trading hours. This continuous operation is a significant advantage in the fast-paced financial markets. Backtesting Capabilities: Many AI trading bots allow for backtesting, enabling traders to test their strategies against historical data before committing real money. This feature is essential for refining trading strategies and improving performance. Challenges and Considerations While AI trading bots offer numerous advantages, there are also challenges to consider: Technical Complexity: Setting up and managing trading bots requires a certain level of technical knowledge. Retail traders may find this daunting, especially if they lack experience in coding or algorithmic trading. Market Adaptability: AI bots may excel in stable market conditions but can struggle during unprecedented events or market volatility. Regular retraining and human oversight are necessary to navigate these challenges effectively. Regulatory Compliance: As the use of AI in trading grows, so does the need for compliance with local regulations. Traders must ensure that their bots adhere to these laws to avoid legal issues. Risk Management: Despite their capabilities, trading bots do not guarantee profits. Users must implement robust risk management strategies and remain vigilant, as flawed algorithms or biased data can lead to significant losses. Conclusion The future of AI in trading bots is promising, with the potential to revolutionize how trading is conducted. By harnessing the power of AI, traders can enhance their strategies, improve decision-making, and stay competitive in an ever-evolving market. However, it is crucial to approach this technology with a clear understanding of its limitations and the importance of human oversight.

The future of AI is increasingly intertwined with the development and utilization of AI technology in trading bots. These advanced tools are transforming the landscape of automated trading by leveraging machine learning and data analysis to enhance trading strategies. Here’s a closer look at how AI technology is shaping the future of trading bots:

Key Features of AI Trading Bots

Data Analysis: AI trading bots can analyze vast amounts of market data at incredible speeds. They identify patterns and predict future trends, allowing for more informed trading decisions. This capability is crucial as it enables bots to react to market changes faster than human traders.

Emotionless Trading: Unlike human traders, AI bots are not influenced by emotions such as fear or greed. This leads to more consistent trading results, as decisions are based solely on data and predefined strategies.

24/7 Operation: AI trading bots can operate around the clock, ensuring that no trading opportunities are missed, even outside regular trading hours. This continuous operation is a significant advantage in the fast-paced financial markets.

Backtesting Capabilities: Many AI trading bots allow for backtesting, enabling traders to test their strategies against historical data before committing real money. This feature is essential for refining trading strategies and improving performance.

Challenges and Considerations

While AI trading bots offer numerous advantages, there are also challenges to consider:

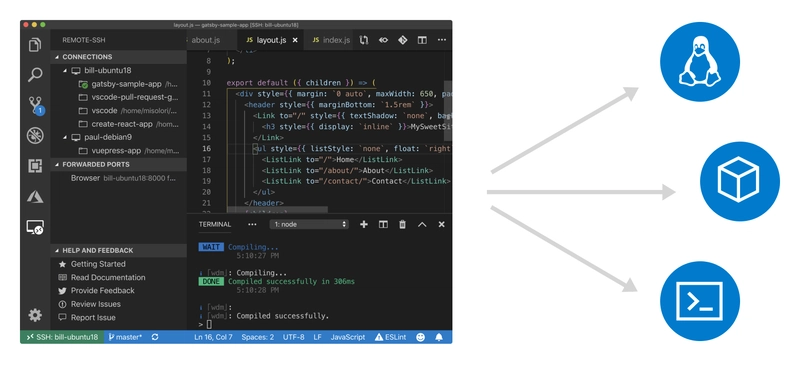

Technical Complexity: Setting up and managing trading bots requires a certain level of technical knowledge. Retail traders may find this daunting, especially if they lack experience in coding or algorithmic trading.

Market Adaptability: AI bots may excel in stable market conditions but can struggle during unprecedented events or market volatility. Regular retraining and human oversight are necessary to navigate these challenges effectively.

Regulatory Compliance: As the use of AI in trading grows, so does the need for compliance with local regulations. Traders must ensure that their bots adhere to these laws to avoid legal issues.

Risk Management: Despite their capabilities, trading bots do not guarantee profits. Users must implement robust risk management strategies and remain vigilant, as flawed algorithms or biased data can lead to significant losses.

Conclusion

The future of AI in trading bots is promising, with the potential to revolutionize how trading is conducted. By harnessing the power of AI, traders can enhance their strategies, improve decision-making, and stay competitive in an ever-evolving market. However, it is crucial to approach this technology with a clear understanding of its limitations and the importance of human oversight.

What's Your Reaction?